GPT Wrappers, Damn the TAM, Public Software Valuation Drivers

Perspectives and Quick Takes From Bigfoot and Our Community of B2B Software Operators and Investors

Happy Wednesday,

Welcome back to another edition of the Bigfoot Bi-Weekly. This week I’m sharing a bit on:

Are GPT Wrapper Businesses in Real Trouble?

Saying Damn to the TAM!

What’s Driving Public Software Valuations?

This newsletter is meant to be informative, possibly a bit entertaining and ideally collaborative. If you have any topics that you'd like me to touch on or any content you'd like us to include - feel free to reach out.

Oh and if you operate or support a B2B software business and are looking for $500k-$5M of non-dilutive capital for growth or runway, drop us a line!

That’s a Wrap? Already?

I ran across a Business Insider article last week talking about OpenAI’s recent release of PDF upload/chat functionality and what it may mean for companies that have popped up with function-specific “wrappers” built on top of OpenAI’s technology. The article’s cautionary word to startups is big tech can blow you up at any time.

Now, this is nothing new. It’s the updated version of a question that has been asked of Founders for years “What if Google decides to get into this business?”. I personally am not a fan of this question, but it is meant to elicit a response around defensibility/differentiation/moat, which is fair enough for any investor to try to glean.

Founders, if you’re asked this question, don’t get defensive. It’s your opportunity to show how dialed into your product/market/business you are, how aware you are of a myriad of external factors that could jeopardize your business, and what you are doing to protect against them.

This can pair with the also fair question of “Is this a feature? A product? A business?”.

The answer is clear for OpenAI — this PDF upload/chat functionality is a feature of a much larger product that is evolving rapidly with exceptional reach and excitement. It’s also generating massive amounts of revenue (reportedly crossing $1BN ARR).

Does this mean that OpenAI “wrapper startups” are screwed now? They obviously don’t have the resourcing, reach, or product velocity of OpenAI. Nor does any startup relative to a larger enterprise.

Like any platform, it behooves OpenAI to have others building on top of it, so I don’t think their aim is to squash that while it’s still in its infancy. A feature release like this is natural and should accelerate platform participants’ efforts.

Now if someone has staked their whole claim on processing PDFs using a LLM, they could be in for a rough go, especially if they are in the early phases and have not built any meaningful value or specialization on top of that. This goes for any wholly generic solution - the market was going to catch up to that whether it was OpenAI or a hundred other startups.

Since I drafted this last week, OpenAI has announced a slew of other things, including the ability for us to build our own GPTs and put them into a GPT store, furthering the open platform concept. They are moving at hyperspeed.

Starting Small to Go BIG

Sam Altman and Paul Graham also espouse this concept.

Wait a second. What are these guys talking about? Aren’t I, as a Founder, meant to find enormous TAMs and attack them with a 10x better or 10x cheaper solution to crush all the stupid, sluggish incumbents? Isn’t that the slide that will blow VCs away and mint me a unicorn?

Not so fast. Find a niche, and serve it. Peter addresses the perils of being TAM-driven in the video, starting minute 17:00.

Here’s the full video of Peter’s talk:

What’s Driving Public Software Valuations?

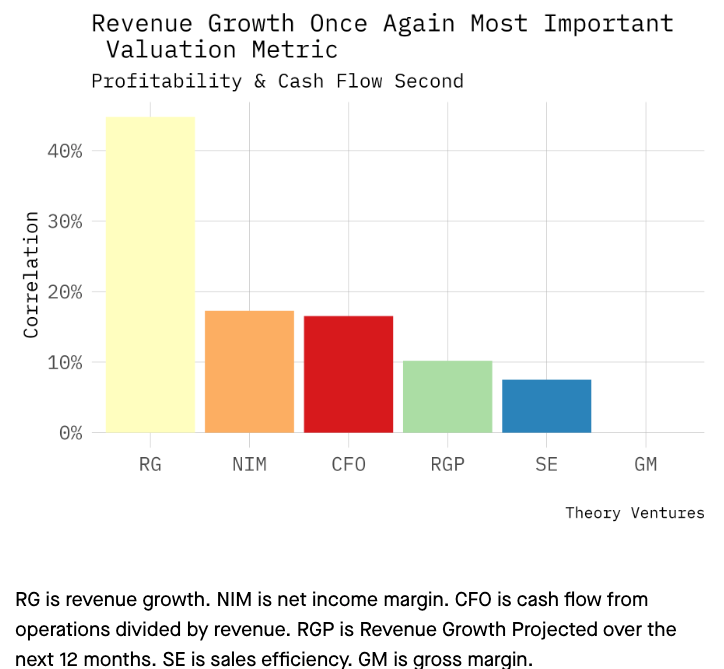

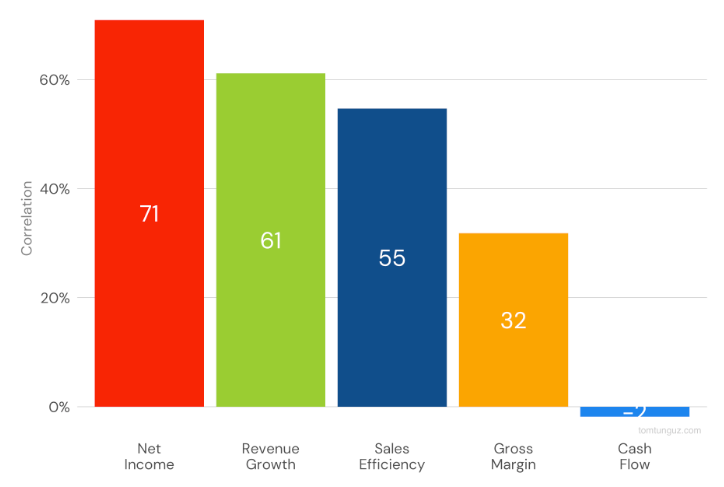

Tom Tunguz at Theory Ventures put out a good post a couple of days ago showing the correlations between different financial performance metrics and a company’s valuation using a sampling of 14 public software companies who have reported their Q3 ‘23 earnings.

All but one of these companies materially outperformed on Q3 earnings with a median upside surprise of 23%, compared to a revenue surprise of 1%.

Crunching the data, Tom discovered that there is no correlation (0.03 R-squared) between these earnings surprises and the revenue multiples of the companies that delivered them.

So, what is driving public software company valuations today? Turns out its revenue growth, is beating net interest margin and cash flow margin pretty handily.

Tom published v1 of this post 15 months ago using Q2 ‘22 data. At that time, net income margin was front of the pack with revenue growth close on its heels.

A few takeaways/assumptions:

It’s now the expectation that public software companies deliver earnings. It’s been priced to such a degree that material upside surprises don’t move the needle. I’m not sure this is “fair”, but it’s the current reality.

Revenue growth remains challenged, so it makes sense that companies delivering it will be rewarded with premium valuations. This feels like a natural shift back from the market. Software companies are meant to exhibit stronger growth profiles, so their valuations should be meaningfully pegged to achieving it.

The correlations between these financial performance metrics and valuations were much stronger 6 quarters ago than they are today. I don’t know why this is. Possibly it means the market is simply more uncertain (and less scientific) now than then.

About Bigfoot Capital

Bigfoot Capital offers growth-oriented loans for B2B software companies with $2M- $20M in revenue. We pride ourselves on partnering with companies and their stakeholders to provide a capital partnership that comes with stability and support.

If you operate or support a B2B software business and want to learn more about alternative capital options that preserve equity, get in touch with our team today.

I joke that TAM stands for That Aspen Money. I imagine a VC asking themselves, "hmmm is this market big enough for me to buy that house in Aspen?" https://springtimeventures.com/vc-minute/043-that-aspen-money/