I'm Sorry Sam [Edit], Some Profitability and Runway Data, Haiku Time!

Perspectives and Quick Takes From Bigfoot and Our Community of B2B Software Operators and Investors

Welcome back to another edition of the Bigfoot Bi-Weekly Roundup. I’m thankful for many things, including you reading and engaging with this.

I hope you’re doing so in something comfortable away from your standard work setup. It’s almost eating time! So, I’m keeping it short this time.

This week I’m sharing a bit on:

My Writer’s Remorse

The Push for Profitability and Runways

Haiku

My Words Have Implications

Man, I feel bad. I knew I had reach and influence, but I truly did not expect this.

See, a couple of weeks ago I wrote a bit about OpenAI and the demise of GPT wrappers and mentioned Sam Altman in my Damn the TAM section (see here).

Less than 2 weeks later, the guy gets freakin’ fired! That board really was not for a monopolistic, “competition is for losers” type of CEO.

To Sam - First and foremost, I want to say that I’m truly sorry and am wishing you the very best at the new mothership. Secondly, I really hope you’ll keep on reading our newsletter [nobody needs to fact check that].

To the OpenAI Board - It’s possible you may have overreacted to my mentions. I was not advocating for regime change. I hope you have a more relaxing week and your family/friends kind of leave you be on this topic (doubtful).

To Satya - 👏 Bring on ClippyGPT!

To You - Rest assured, I will tread a bit more lightly with my words now that I realize the weight they carry. With reach comes responsibility. I’m thankful you’ve given me the outlet to get this weight off my chest. Also, I’m curious:

Update: Sam is back at OpenAI, happened before this even went out, guess I should have procrastinated just a bit more.

Keep Pushing to be Default Alive!

A couple of slides I thought paired nicely together along with a few thoughts.

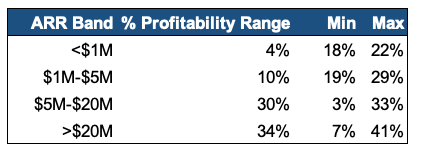

This slide shows the % of companies that are profitable at a given revenue level range with a given growth rate profile.

My Opinions:

Top row - Slow Growth: 100% of these companies should be profitable across the revenue ranges. If you’re growing sub 15%, get profitable now! Until you do, you’re stuck in Quadrant III (think bottom left of Gartner chart). Nobody wants to be in Quadrant III.

Middle row - Medium Growth: I think these should at least be in the 40+% area and higher for sub $5M ARR businesses. Seeing that 22% of sub $5M ARR businesses growing <50% are profitable is pretty discouraging. More medicine to be taken.

Bottom Row - Fast Growth: I have less sensitivity to these. That said, of course, the level of burn needs to be reasonable as we’ve all seen how quickly growth can degrade and companies in this row can find themselves moving to medium or slow growth.

Overall: Looking at this by ARR band, there really should be materially more variance here for % profitable companies across the growth bands for the smaller-scale businesses.

My guess was the lack of variance may be due to sample size for those size businesses in OpenView’s report, but then I looked and <$5M ARR businesses made up 54% of respondents, so who knows.

Anyways, in closing…see the graph below and let’s all keep pushing!

Leaving you with a Thanksgiving haiku

…or not

Fine then ChatGPT here’s one for you

Why did you fail me?

Has your Board forbidden you?

To Create for Me

About Bigfoot Capital

Bigfoot Capital offers growth-oriented loans for B2B software companies with $2M- $20M in revenue. We pride ourselves on partnering with companies and their stakeholders to provide a capital partnership that comes with stability and support.

If you operate or support a B2B software business and want to learn more about alternative capital options that preserve equity, get in touch with our team today.